- Quiver Quantitative

- Posts

- Where did the $3.8B in insider volume go?

Where did the $3.8B in insider volume go?

Diamondback Energy's largest insider sells $331M in stock into strength in stock via a block trade + CEO who dumped stock immediately after being fired.

THE QUIVER QUANT

EXECUTIVE SUMMARY

Senator John Hickenlooper (D-CO) filed four trades in a single batch—selling Lowe's and (TJX) while buying up to $250K.

Insider volume hit $3.8 billion. SGF FANG Holdings (Stephen’s Family ownership) who acquired (FANG) stock during it’s acquisition of Endeavor Energy Resources, dumped $331M in Diamondback Energy. On the buy side, multiple institutions poured $40M+ into Mane Inc ($MANE) at $17/share.

Homeland Security Committee (Senate) portfolio surged 9.34% in 7 days. Pelosi filed 6 new call option trades on (AMZN), (GOOGL), (NVDA), and (VST) worth $1M–$5M+

MIDTERMS

Things are heating up for the midterms. Here are the current probabilities: The House: 83% Dem · Senate: 65% GOP · (0% change week over week)

Our new midterm elections dashboard is live on Quiver. Check it out to see congressional races and who is favored to win.

STRATEGY PERFORMANCE

Track every trade in real time with Quiver Premium

Today's Signals

01 Editorial Quant

02 Midterm Money Flow & Congress Activity

03 Insider Trades

04 Quiver News

05 Quiver Socials

-David Love

THE EDITORIAL QUANT (THURSDAY PREVIEW)

Fired for Cause at 10 A.M., Dumped the Stock by Lunch

The SEC just charged former Comtech Telecommunications ($CMTL) CEO Ken Peterman with insider trading. Told he was being fired for cause on March 12, 2024, Peterman allegedly sold stock that same day—during a blackout period—before earnings dropped 25%. The avoided loss? $12,000. Internal controls blocked an even larger illegal trade. The ultra-petty version of insider trading: not a grand scheme, just "I got fired, please sell my stock before everyone finds out why."

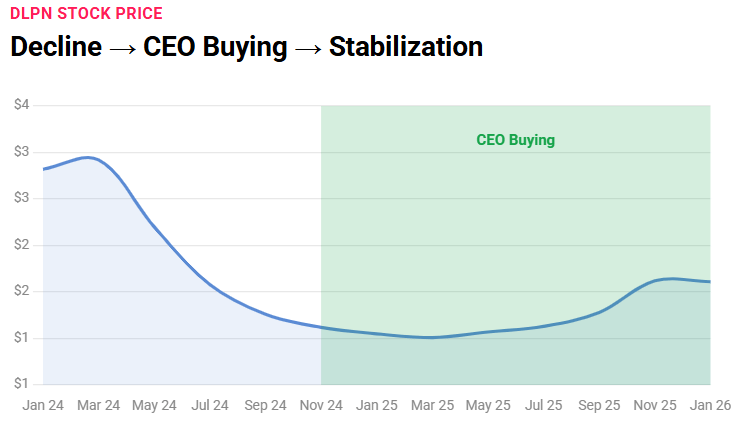

Also this Thursday: The CEO buying his own micro-cap 35 times in a year Dolphin Entertainment (DLPN). And why Arlo's CEO selling $723K while receiving fresh RSUs is the modern compensation Rorschach test. See the full breakdown →

QUIVER NEWS

What we’re watching:

→ Why AI’s Next Moat Could Be Marketing, Not Models

The Super Bowl’s flood of artificial intelligence ads did more than confirm a trend — it clarified: Read analysis →

→ AI Spending is Reviving the 100-Year Bond

A promise to pay the same amount of money every year, indefinitely, is one of finance’s most deceptively powerful ideas: Read analysis →

→ Gamestop Hedge Fund Activity

We have seen 150 institutional investors add shares of GameStop (GME) stock to their portfolio, and 170 decrease their positions: Read analysis →

SOCIAL MEDIA ROUNDUP

WHAT QUIVER’S POSTING

@quiverquant They know exactly where the line is… #quiverquant #news #geopolitics #fypage #fyp