- Quiver Quantitative

- Posts

- Pelosi Sold PayPal Before 27% Drop

Pelosi Sold PayPal Before 27% Drop

Congress positioning before key votes. ADM's $40M fraud fine. Midterms dashboard live.

THE QUIVER QUANT

EXECUTIVE SUMMARY

This week's power players are making headlines.

Ken Griffin isn't holding back, warning that CEO decision-making is being warped by a White House that rewards loyalty over merit.

Meanwhile, Nancy Pelosi's timing raises eyebrows again: she sold PayPal two weeks before shares cratered 27% on an earnings miss. And on the optimistic side?

Blackstone's Jon Gray is calling it—2026 is the year the IPO window finally blows open. Three stories. Three signals. Let's dig in

MIDTERMS

Things are heating up for the midterms. Here are the current probabilities: The House: 83% Dem · Senate: 65% GOP ·

Our new midterm elections dashboard is live on Quiver. Check it out to see congressional races and who is favored to win.

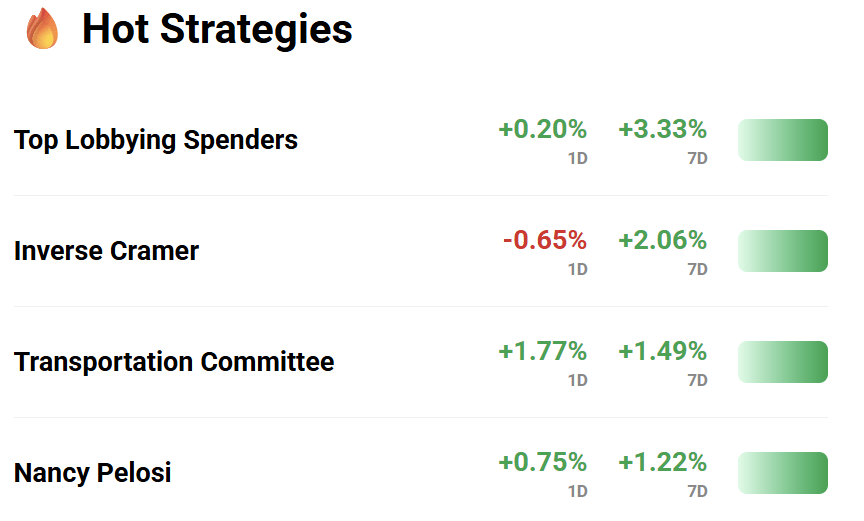

STRATEGY PERFORMANCE

Track every trade in real time with Quiver Premium

Today's Signals

01 Editorial Quant

02 Midterm Money Flow & Congress Activity

03 Insider Trades

04 Quiver News

05 Quiver Socials

-David Love

THE EDITORIAL QUANT

ADM Called it “Risk Sharing.” The SEC Called It Fraud.

There's a certain poetry to the language arc of accounting fraud. Archer-Daniels-Midland executives started by calling their $20 million revenue manipulation a "rebate." When that sounded too much like what it was, they rebranded it as "risk sharing." The SEC, perhaps lacking the same creative writing budget, eventually settled on "accounting fraud" and a $40 million fine, (about 0.12% of market cap), or what the stock moves on a slow Tuesday. The word "fraud" is now in the official record, which I suppose is something.

The timing is where it gets interesting. ADM disclosed the investigation on January 22, 2024. Stock dropped to $47.73 a 29.4% drawdown. By late August, it had recovered to 58, still 14% below pre-investigation but 21% above the lows. This is when CEO Juan Luciano sold 324,821 shares across five days. See the full breakdown →

Want more stories like this in your inbox every week?

QUIVER NEWS

What we’re watching:

→ Ken Griffin Says CEOs Fear a White House that Rewards Loyalist

Ken Griffin sharpened his criticism of the Trump administration, warning that a political culture perceived as rewarding loyalty: Read analysis →

→ Pelosi Sold PayPal Stock Before 27% Drop

Nancy Pelosi disclosed a sale of PayPal Holdings, Inc. ($PYPL) common stock roughly two weeks before Read analysis →

→ Blackstone’s Jon Gray Says 2026 Will Be the Year of IPOs

Jon Gray is betting that the long-awaited reopening of the US IPO market is finally at hand, arguing that 2026 is shaping up to be a breakout year: Read analysis →