- Quiver Quantitative

- Posts

- Major Updates to Quiver's Insider Trading Dashboard, New Congressional Trading Activity, and More

Major Updates to Quiver's Insider Trading Dashboard, New Congressional Trading Activity, and More

QUIVER PREMIUM

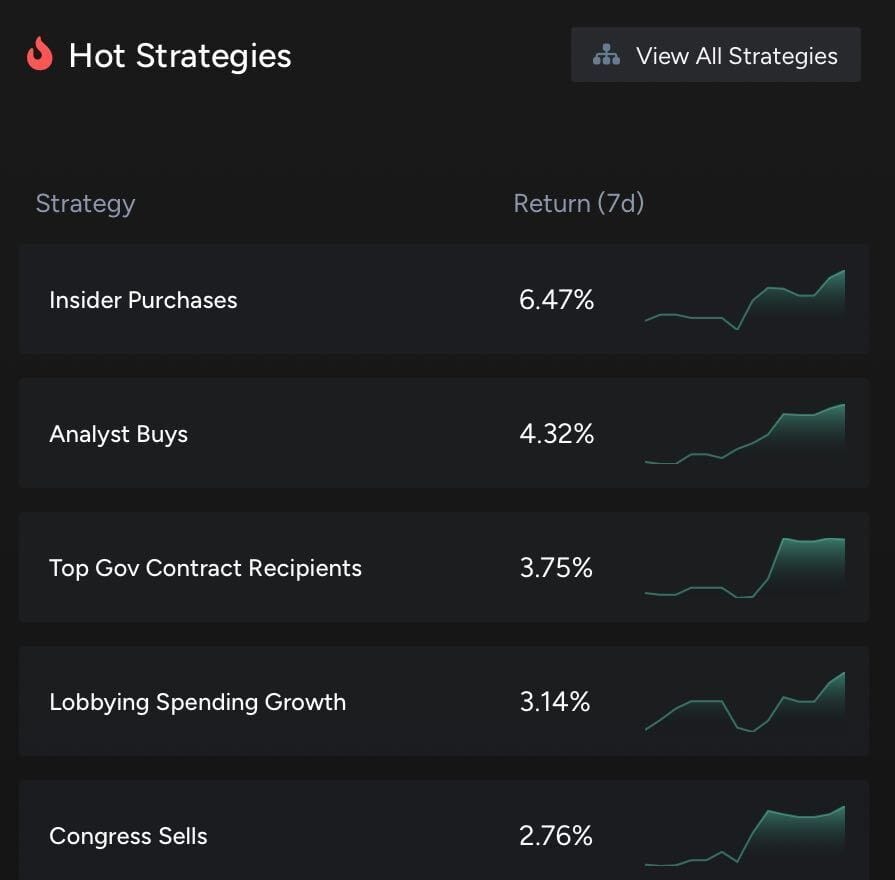

Check out our top Performing Strategies

Each week, we are highlighting the top Quiver Strategies trending right now:

In today’s edition:

POLITICS

Congress Trades & News

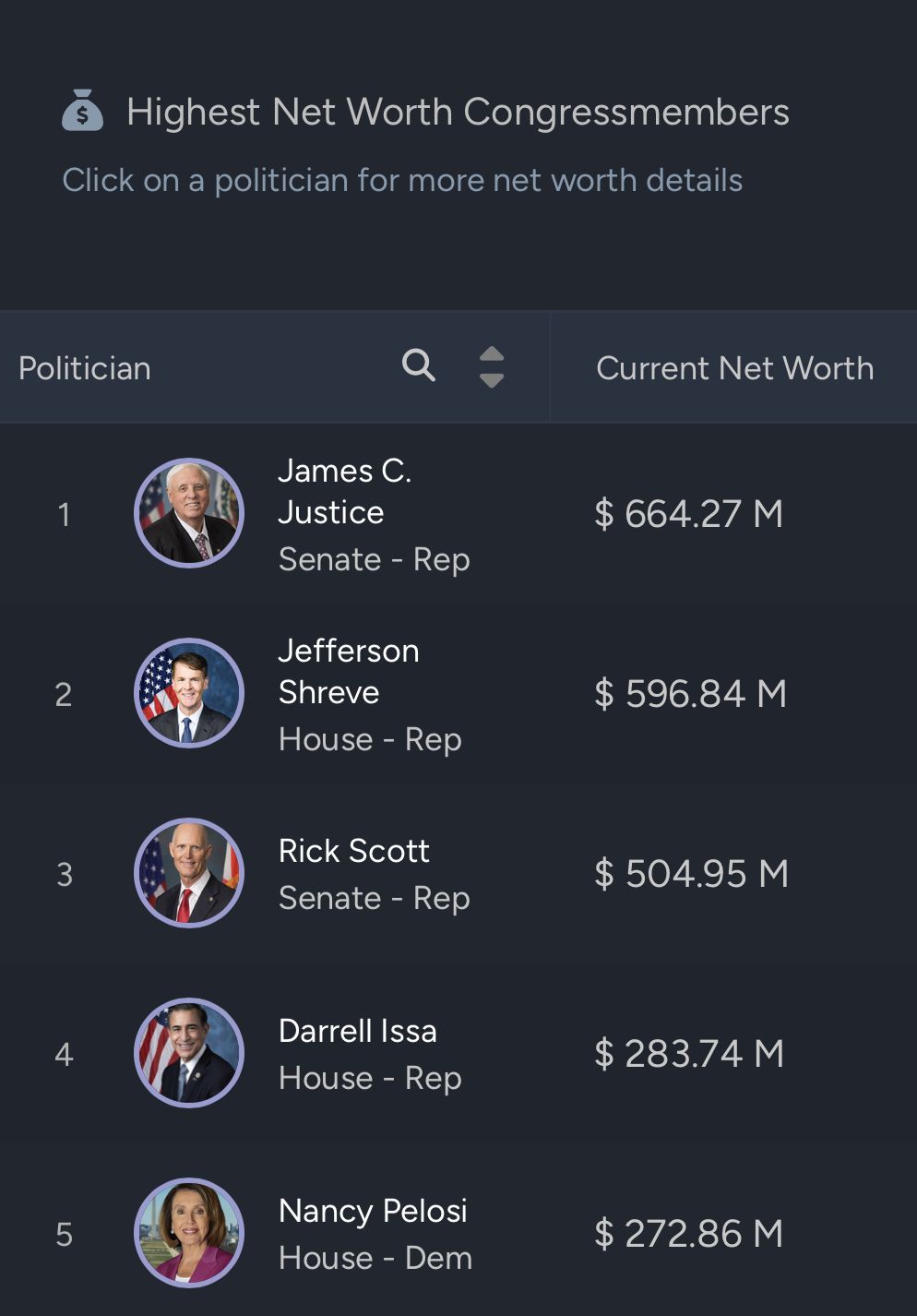

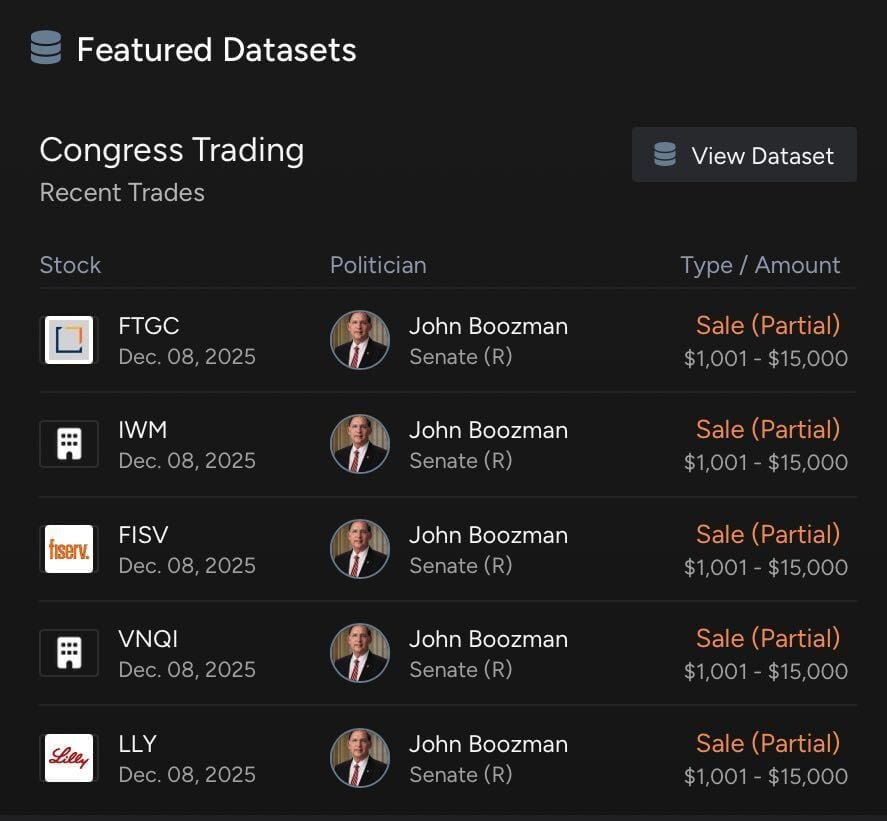

Insights from our Congress Trading Dashboard

Several politicians & members of Congress have already made millions of dollars in the stock market in 2025:

Congress heads into this week juggling a packed agenda, with lawmakers racing to finalize a massive annual defense policy bill that actually exceeds President Trump’s own spending request. The package is set to top roughly $890 billion and includes a pay raise for troops, major investments in weapons systems, and new provisions touching everything from Ukraine aid to hot-button cultural issues inside the military ranks.

On the ethics front, pressure is intensifying around a ban on congressional stock trading. A bipartisan coalition in the House is now backing a measure that would prohibit lawmakers and their immediate families from trading individual stocks, with members using procedural maneuvers to try to force a floor vote over leadership’s hesitation. Momentum and public support are clearly building, but with party leaders still divided, the odds of it becoming law this session remain uncertain.

Abroad, Gaza remains at the center of U.S. foreign policy as the American-brokered ceasefire and peace plan moves into a critical second phase. Israel and Hamas are poised to shift from the initial hostage-release and pause in fighting toward negotiations over longer-term arrangements, including security guarantees, potential international forces on the ground, and the future of Hamas’ military capabilities—talks that will bring Israel’s leadership to Washington later this month.

In other news we have some Congress trades to cover this week:

John Boozman (R) (with an estimated net worth of $3.47M) had numerous trades including (CRM), (AMZN), (LLY), (MBB) and more:

He bought up to $15K in PayPal stock filed on 12/8/25 and (PYPL) is up +0.91% vs an S&P 500 +3.74%

Bought up to $15K in Amazon stock filed on 12/8/25, and (AMZN) is down -4.50% vs an S&P 500 +1.72%.

Sold up to $15K in Salesforce stock filed on 12/8/25. (CRM) is up +7.94% vs and S&P 500 +1.72% since the trade.

Senator Markwayne Mullin (R) filed 4 new trades:

Purchased up to $100K in Capital One stock. (COF) is up +4.64% vs an S&P 500 +0.34%.

Purchased up to $50K in Pentair stock. (PNR) is down -4.09% vs a flat S&P 500 +0.34%.

Sold up to $50K worth of CSX stock. (CSX) is up +3.57% vs an S&P 500 flat +0.45%.

Sold up to $50k of Zoetis Inc. (ZTS) is down -3.03% vs an S&P 500 flat +0.45%

Rep Cleo Fields (D) filed 11 trades on 11/12/25, mostly purchases. These included:

2x Nvidia stock purchases up to $300k. (NVDA) is down nearly +8% vs an S&P 500 flat -0.96% since trade.

He sold his Chipotle position of up to $50k. (CMG) is down nearly -5% vs an S&P 500 flat -0.96% since trade.

2x Apple stock purchases of up to $750k. (AAPL) is up +4.03% vs an S&P 500 flat -0.96% since trade.

Fundraising:

We've received Q3 fundraising data for members of Congress. Here's who's fundraised the most & the % of individual donors contributions:

🔵Raja Krishnamoorthi: $12.2M (96%)

🔵Jon Ossoff: $12.08M (99%)

🔵Roy Cooper $10.92M (91%)

🔴Dan Sullivan $7.77M (93%)

🔵Sherrod Brown $7.02% (90%)

DATA ROUNDUP

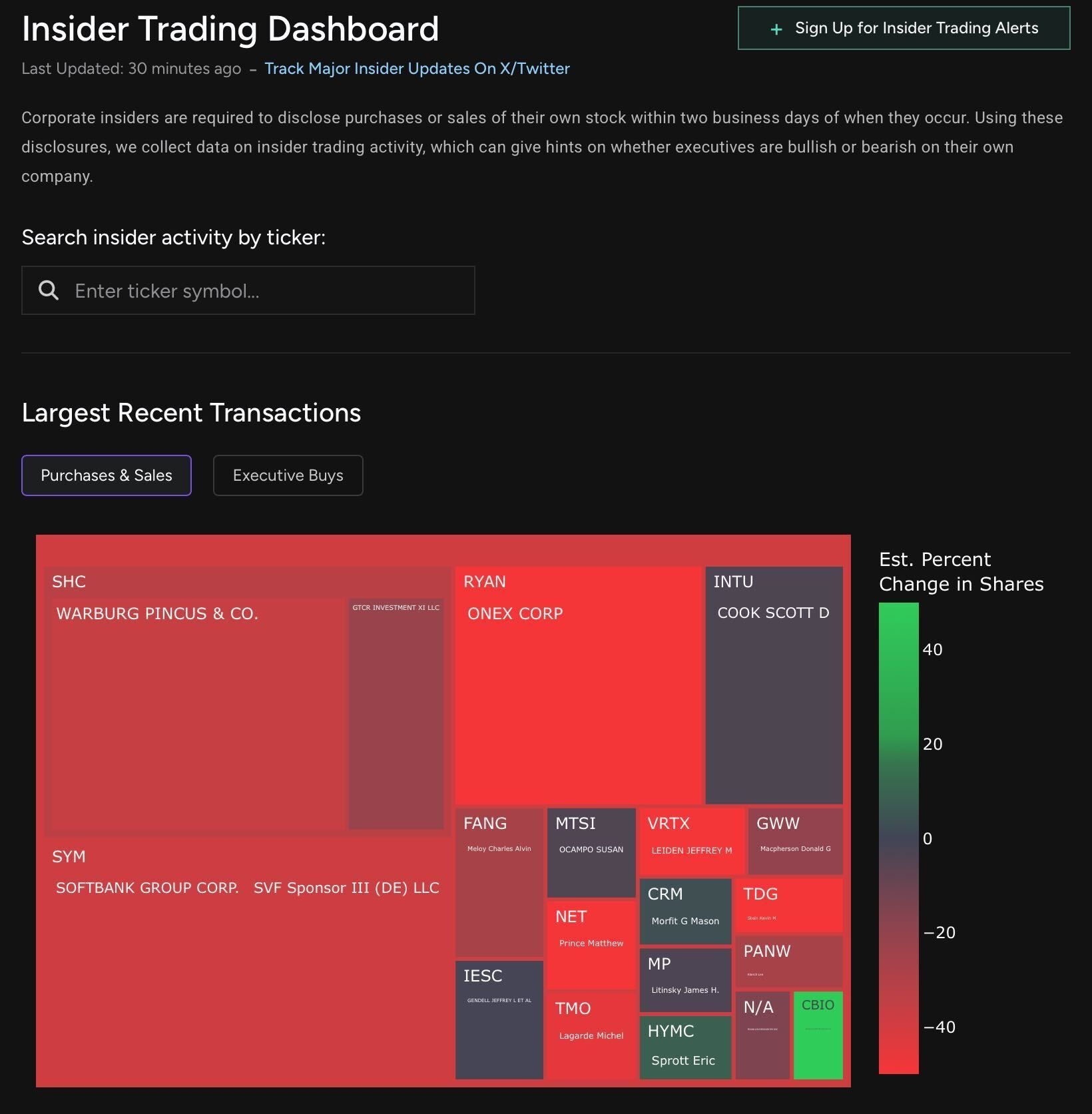

Insider Dashboard UI Upgrades

Quiver’s Insider Trading Dashboard lets you see what corporate executives are doing with their own stock in near real time, using public Form 4 disclosures filed within two business days of each trade.

These transactions can provide an additional signal on whether insiders are leaning bullish or bearish on their companies.

What’s New in the Insider Dashboard

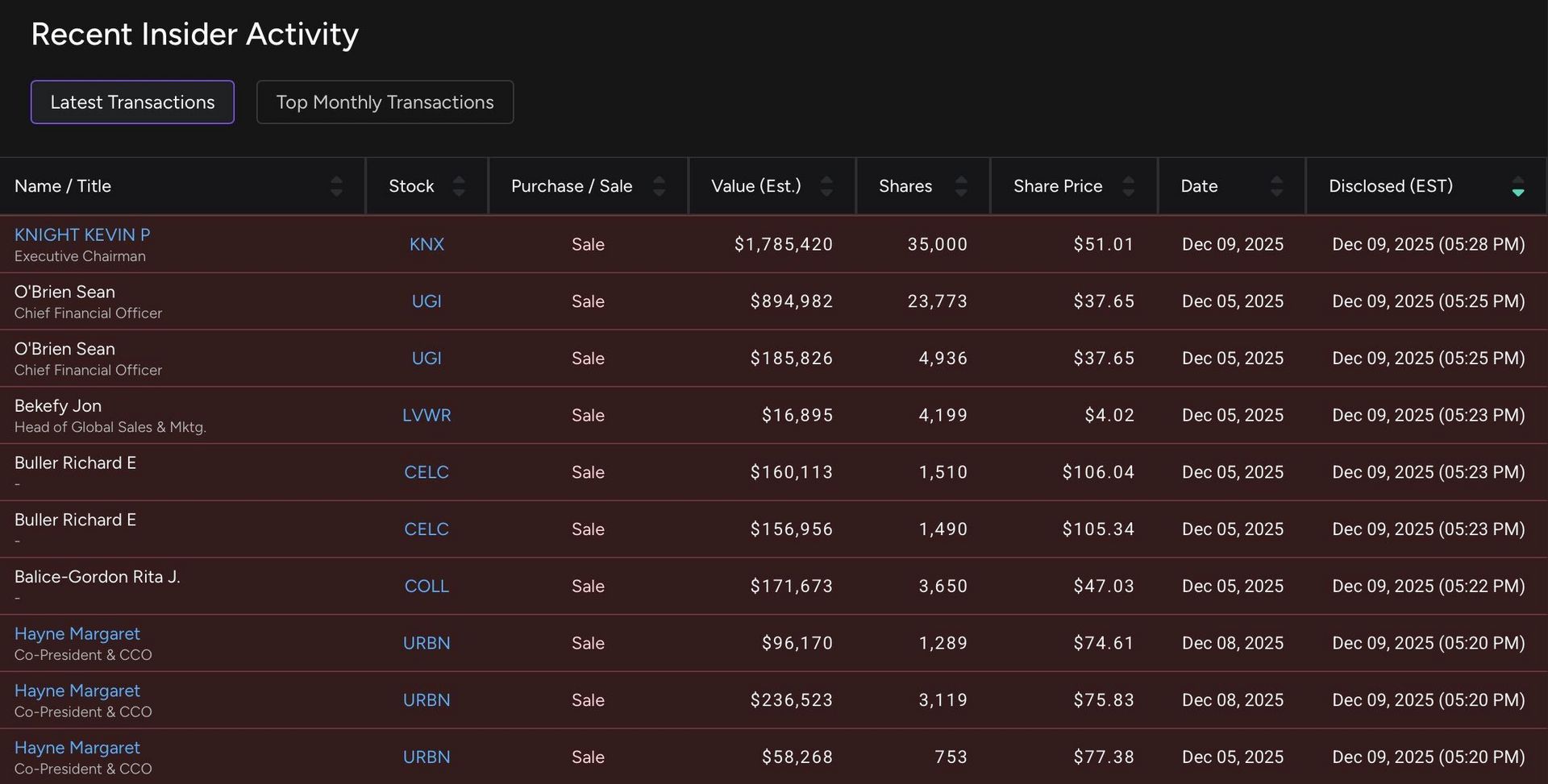

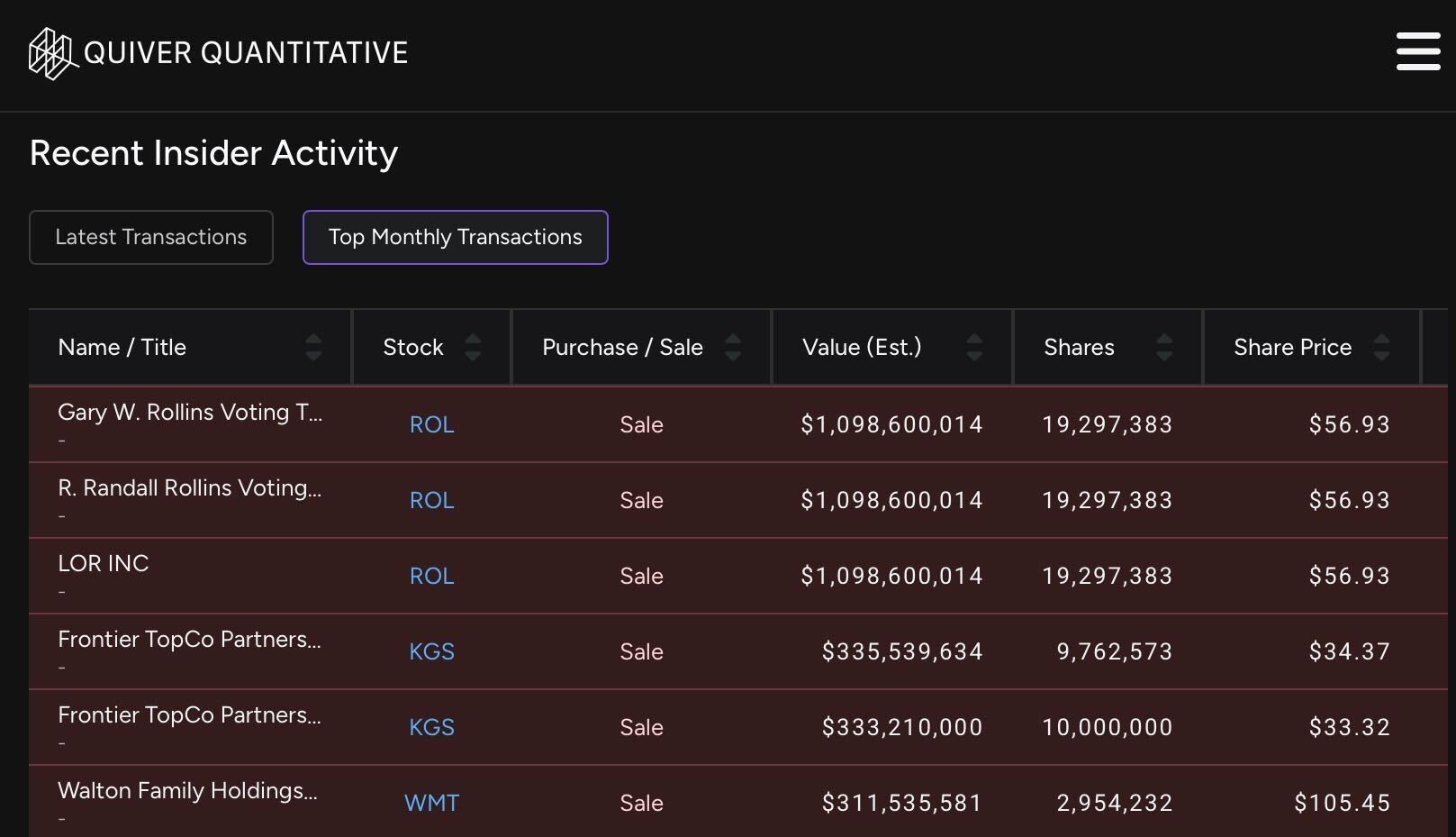

The main “Recent Insider Activity” table has been redesigned to make it easier to scan and explore the latest trades, with clearer columns for trade type, estimated value, share count, price, trade date, and disclosure timestamp.

Users can now more quickly identify notable buys or sells and pivot between different names without leaving the dashboard.

New Top Monthly Transactions View

Alongside the latest trades, there is now a “Top Monthly Transactions” view highlighting the largest insider purchases and sales over the past month, including role, ticker, size of the trade, and execution price.

This makes it simple to surface the highest-conviction insider moves and track where C-suites and large shareholders are putting real capital to work over a longer window.

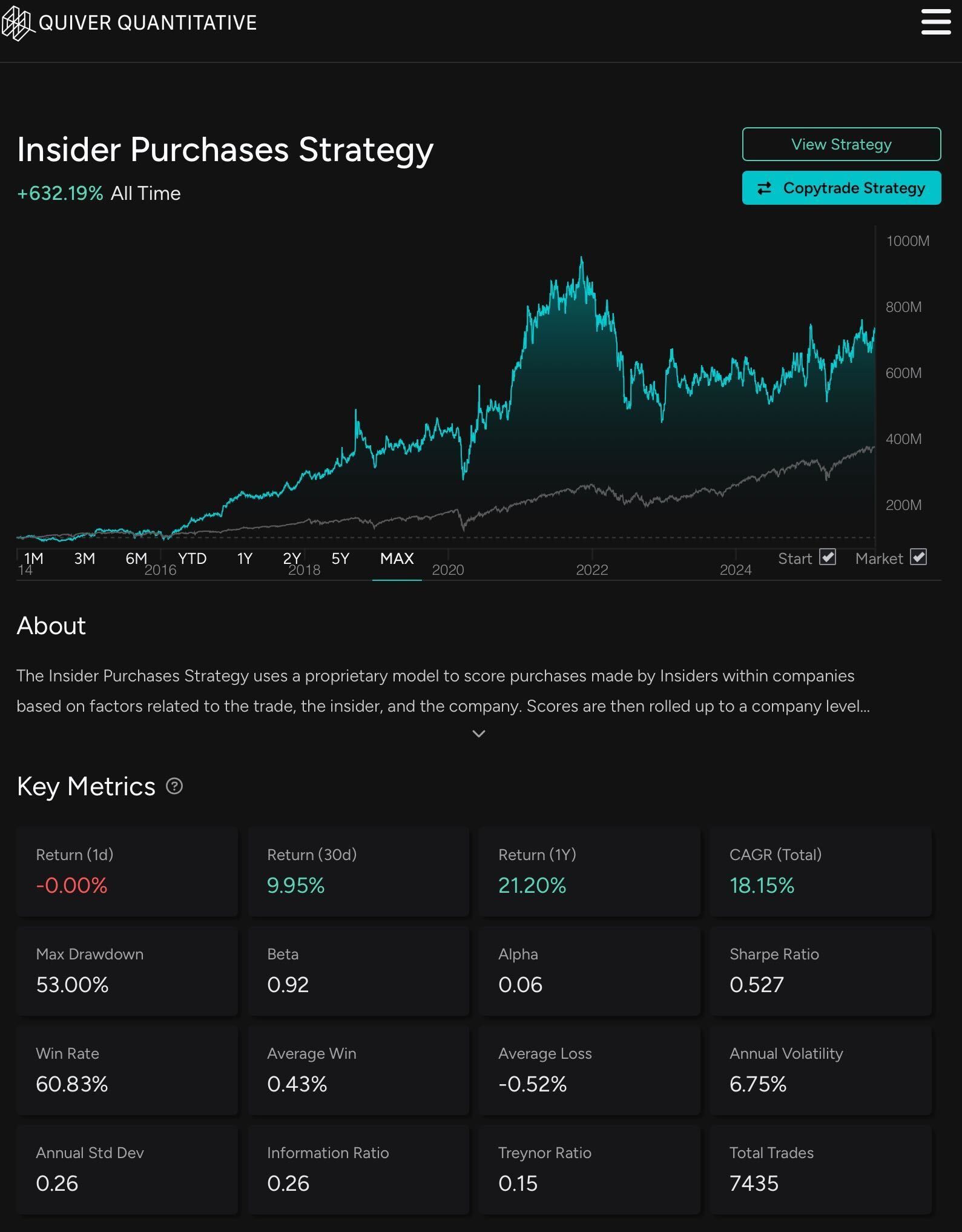

Insider Trading Strategy

Check out the Quiver Insider Purchases Trading Strategy and sign up to copytrade just like C-suite executives:

Insights from our Quiver Insiders Dashboard

NEWS

Ellison’s All-Cash Offer (WBD) Reshapes the Media M&A Landscape

Paramount Skydance’s (PARA) $108 billion hostile bid for Warner Bros. Discovery (WBD) has upended the media landscape, escalating a high-stakes battle for control of one of Hollywood’s most important content libraries. The $30-per-share all-cash proposal surpasses Netflix’s (NFLX) earlier $27.75 cash-and-stock offer and aims to acquire the entire company rather than just its studios and streaming business. CEO David Ellison argued that the bid provides “superior value” and a faster, more certain regulatory path — a claim that will be tested as both sides court shareholders and brace for global antitrust scrutiny.

The offer arrives just days after Warner Bros. agreed to merge parts of its business with Netflix, a deal that includes a planned spinoff of its cable assets such as CNN, TNT and Discovery Channel. Paramount disputes the implied value of that arrangement, asserting that its own offer delivers roughly $18 billion more in cash. Analysts remain divided: some value the spinoff at closer to $2 a share, while Bloomberg Intelligence estimates the cable assets could be worth twice that. The unresolved valuation gap now sits at the center of a sharply intensifying bidding war.

Market Overview:

Paramount launches $108B hostile bid, topping Netflix’s offer for Warner Bros. Discovery

Warner Bros. shares rise 5.8% while Paramount gains 5% and Netflix drops 4.7%

Regulatory scrutiny looms as both bidders face global antitrust and national security reviews

Key Points:

Paramount says its all-cash bid delivers $18B more to shareholders than Netflix’s structure

Financing includes $11.8B from the Ellison family and $24B from Middle Eastern sovereign funds

Breaking the Netflix deal would trigger a $2.8B breakup fee for Warner Bros