- Quiver Quantitative

- Posts

- How Congress is Trading the AI Boom

How Congress is Trading the AI Boom

Rep. Cleo Fields files $1M+ in stock buys. See which Wikipedia Strategy stocks gained this month...

QUIVER PREMIUM

Check out our top Performing Strategies

Each week, we are highlighting the top Quiver Strategies trending right now:

In today’s edition:

POLITICS

Congress Trades & News

Insights from our Congress Trading Dashboard

Several politicians & members of Congress have already made millions of dollars in the stock market in 2025:

Congress just made waves with the GENIUS Act, the first federal rulebook for stablecoins. The bill brings full reserve requirements, monthly audits, and new oversight—paving the way for banks and big retailers to enter the digital dollar race. The move could rapidly expand the $160B stablecoin market, though critics warn about potential loopholes and systemic risks.

Redistricting drama hit full throttle in Texas, with Republicans pushing for new maps that could deliver five more GOP House seats. The showdown led over 50 Democratic lawmakers to stage a walkout, triggering national headlines and potential legal battles.

In California, state leaders fired back, considering their own partisan map redraw if Texas moves forward. The tit-for-tat signals a new era of aggressive, high-stakes map making with national control at stake.

Meanwhile, the long-awaited Congressional trading ban finally gained real traction: a bipartisan Senate panel advanced the measure, which would bar lawmakers, the President, and Vice President from trading stocks and require them to divest investments. Despite strong public support and White House attention, the bill faces an uncertain path—GOP leaders are still resisting a full Senate vote, and House backers are prepping a discharge petition to force the issue this fall.

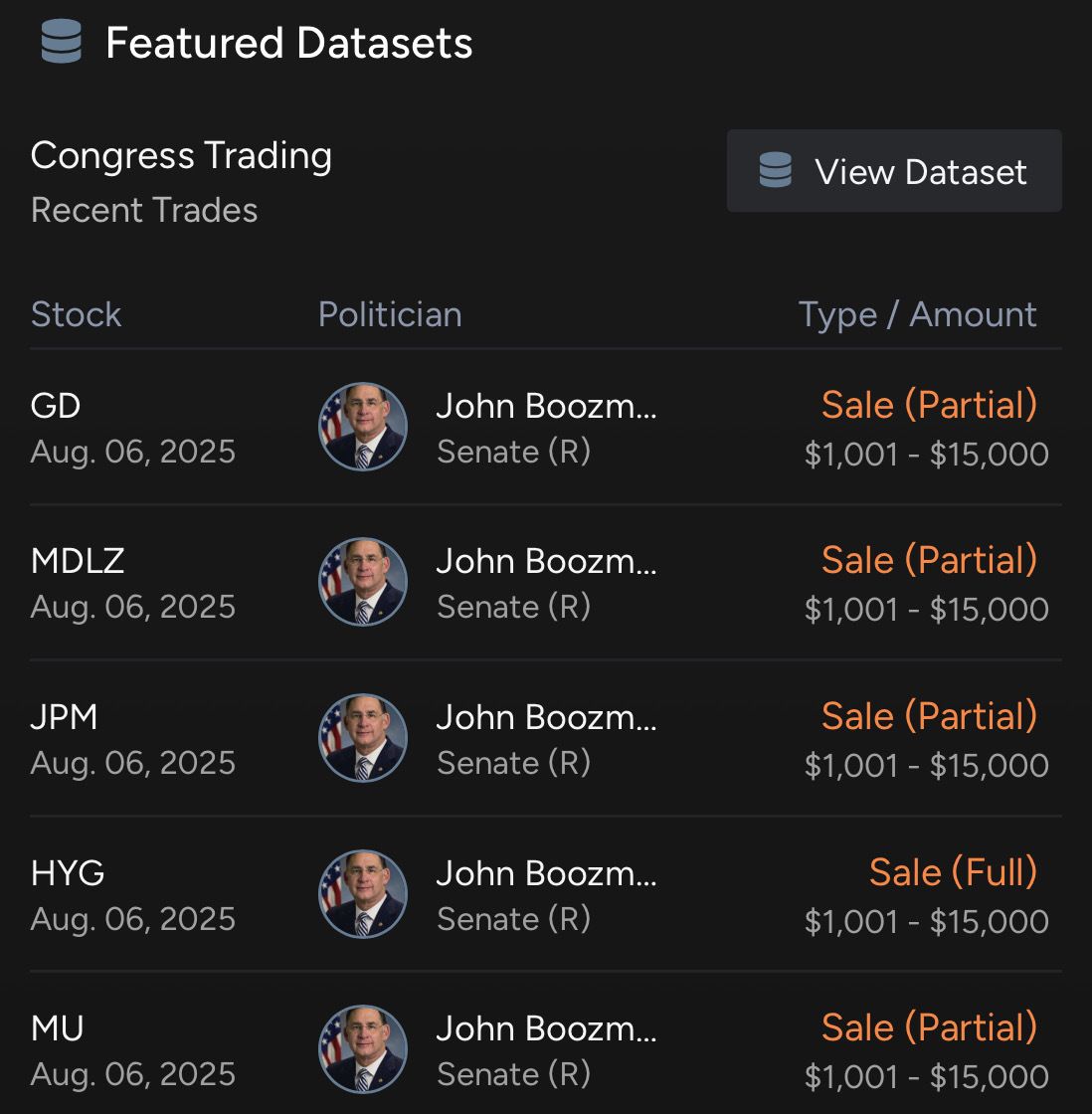

In other news we have some Congress trades to cover this week:

Last month, one of Representative Robert Bresnahan's (R) trades caught our eye, when he purchased up to $15k of Credo Technology on 6/3/25. (CRDO) has now risen 63% since this trade vs an S&P 500 of 6.18%.

Rep. Debbie Wasserman Schultz (D) bought up to $15K in Ichor Holdings. (ICHR) designs components for semiconductor capital equipment. This is the first time we have seen a politician buy the stock in over 8 years. She is up +16.11% vs an S&P 500 +0.78%.

Rep. Cleo Fields (D) just filed on August 6th over a million dollars in stock purchases:

Purchased up to $100k in Robinhood stock , he made this purchase of (HOOD) while sitting on the Financial Services Committee and is up +6.22% vs an S&P 500 +0.67%

Purchased up to $350k of Palantir and is up +15.86% due to (PLTR) recent earnings vs an S&P 500 down -0.61%.

Purchased up to $600k of Microsoft stock and is up +2.94% on this (MSFT) trade vs an S&P 500 down -0.35%.

Fundraising:

We've received Q2 fundraising data for members of Congress. Here's who's fundraised the most & the % of individual donors contributions:

🔵Senator Jon Ossoff (D) $10M (97%)

🔵Senator Cory Booker (D) $9.69M (98%)

🔵 Rep. Alexandria Ocasio-Cortez (D) $5.82M (99%)

🔵 Senator Bernie Sanders (D) $4.57M (100%)

DATA ROUNDUP

Quiver Strategies Analysis

We are going to switch things up and provide commentary on three of our Quiver Strategies. For those that don’t know Quiver Strategies are backtested quantitative strategies that Quiver has built using our datasets for you to copytrade.

You can find these strategies and holdings on the Quiver website under “Strategies” and can copytrade them through our Trader subscription.

Wikipedia Most-Viewed Strategy (+5.49%)

The Wikipedia Most‑Viewed (Month) strategy gained about 5% over the past week as investors piled back into big tech. Even with mixed macro news — tariffs from Washington and a still‑fickle consumer backdrop — the Nasdaq hit another record high, which lifted the portfolio’s heavily weighted tech holdings. Because the strategy allocates more capital to companies that draw the most Wikipedia attention, it naturally tilts toward market darlings with news‑driven momentum.

Apple provided the biggest boost. Its announcement of a $600 billion U.S. investment calmed trade tensions and sent the stock higher. Palantir posted a blowout quarter, with U.S. commercial sales up 93% year over year, while Reddit’s quarterly revenue jump of 78% and user growth of 21% powered a double‑digit stock pop. These three names together represent a sizable chunk of the portfolio, so their rallies more than offset weakness in smaller positions like Pinterest and Manchester United.

Other contributors included Tesla, which edged up after its board approved a $29 billion stock award to keep Elon Musk focused on AI and robotics. Meta jumped on earnings and stronger guidance, highlighting how AI‑driven ad targeting is boosting revenues. Smaller gains from Alphabet, Spotify, Palantir and Walmart rounded out the week. In essence, the strategy’s focus on widely watched companies meant that a cluster of AI‑rich, attention‑grabbing earnings beats drove most of the portfolio’s outperformance.

Energy and Commerce Committee (House) Strategy (+4.88%)

The Energy and Commerce Committee (House) Strategy’s 4.88% jump over the past week was led by strong moves in its largest weights—Farmers & Merchants Bancorp, Walmart, and Netflix. Farmers & Merchants popped after an earnings beat and dividend hike signaled ongoing balance-sheet strength, attracting fresh institutional interest. Walmart gained on broad retail momentum following mid-summer consumer spending spikes, with investors positioning ahead of its upcoming earnings report.

AutoZone added further lift as institutional buying activity increased, highlighted by large stake additions from major funds. The stock’s steady uptrend reflects confidence in its defensive auto-parts niche and stable cash flow profile, with bullish sentiment supported by improving technical setups.

Netflix and Intuit provided incremental support, with Netflix benefiting from renewed optimism around subscriber growth and upcoming content releases, while Intuit stabilized after recent weakness in tech. The combination of earnings-driven strength in financials, steady consumer demand in retail and auto, and selective tech resilience drove the portfolio’s sharp move higher.

Insights from our Quiver Strategies

NEWS

Enterprise AI on Demand: How GPT-5 Aims to Fund the Data-Center Boom

OpenAI on Thursday unveiled GPT-5, its most advanced AI language model to date, making it available to all 700 million ChatGPT users. The launch comes at a pivotal moment as enterprises and investors demand tangible returns on the staggering capital poured into AI infrastructure. With generative AI now central to corporate strategy, GPT-5’s real-world performance will determine whether OpenAI can sustain its rapid growth and justify its escalating valuation.

GPT-5 boasts enhanced enterprise capabilities—auto-coding software on demand, expert-level writing, health analytics and financial modeling—aimed at winning over business users. The rollout coincides with nearly $400 billion in planned AI data-center spending by Alphabet, Meta, Amazon and Microsoft this year. Despite robust consumer engagement, economists like Noah Smith warn that consumer chat revenue alone cannot underwrite these investments. CEO Sam Altman highlighted GPT-5’s “test-time compute” router architecture as a breakthrough for tackling complex tasks, but the true measure will be enterprise adoption and revenue.

Market Overview:

Major tech firms back OpenAI as competition for AI infrastructure intensifies.

Enterprise feature set critical to shifting spend from consumer to corporate budgets.

Investor focus turns to monetization of on-demand software and test-time compute.

Key Points:

GPT-5 available to 700 million ChatGPT users, emphasizing enterprise use cases.

Top AI backers—GOOGL, META, AMZN, MSFT—plan ~$400 billion in data-center capex.

OpenAI explores $500 billion valuation for employee liquidity, up from $300 billion.