- Quiver Quantitative

- Posts

- Follow the Money Behind Every Political Campaign in Real-Time

Follow the Money Behind Every Political Campaign in Real-Time

Trump's $82M bond bet + new campaign finance tracker + this week's Congressional trades.

QUIVER PREMIUM

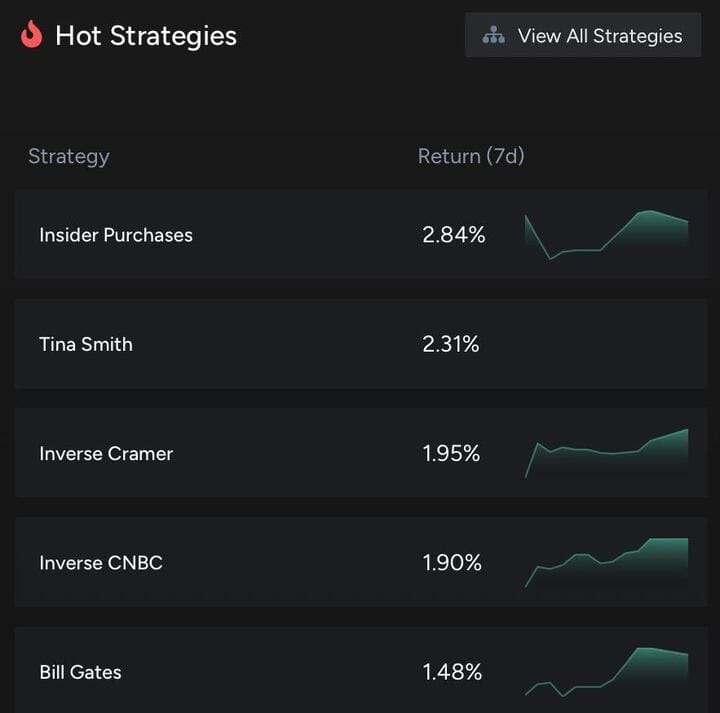

Check out our top Performing Strategies

Each week, we are highlighting the top Quiver Strategies trending right now:

In today’s edition:

POLITICS

Congress Trades & News

Insights from our Congress Trading Dashboard

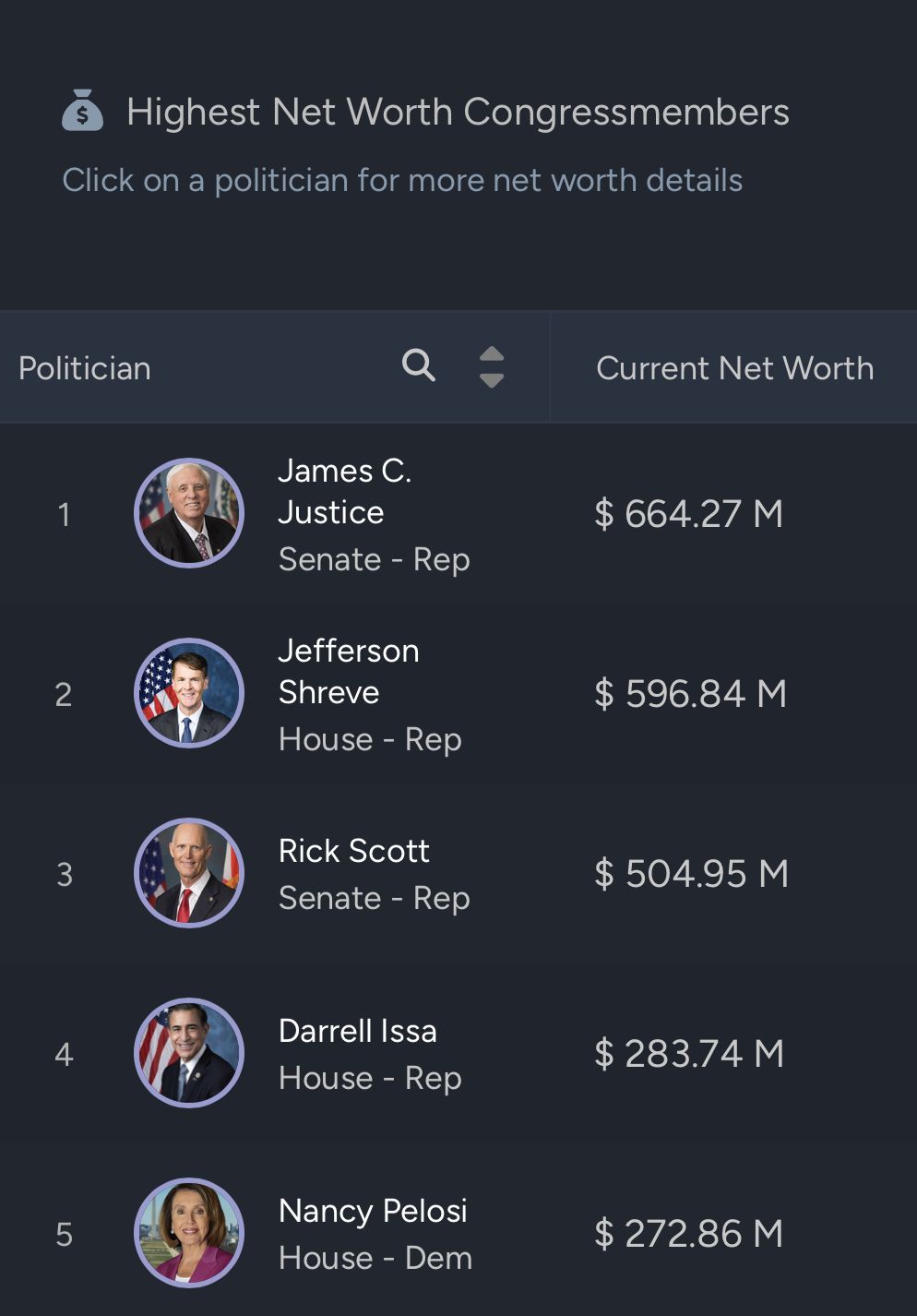

Several politicians & members of Congress have already made millions of dollars in the stock market in 2025:

Congress finally brought the longest government shutdown in U.S. history to an end this week, reopening federal agencies after more than six weeks of disruption. While most programs are now back online, battles over health care subsidies and expiring tax credits remain unresolved, setting the stage for more high-stakes negotiations in January when temporary funding runs out. The compromise saw defections on both sides, with some Senate Democrats ultimately joining Republicans to hammer out the final deal.

Internationally, the U.S. pushed ahead with implementation of the Gaza peace agreement, with President Trump championing a phased approach to stabilize the region after the historic ceasefire last month. This week, diplomatic efforts intensified as the United Nations Security Council prepared to authorize an international stabilization force to help secure Gaza and oversee the transfer of governance to a technocratic Palestinian body. While hostages have been released and fighting paused, further negotiations are underway over demilitarization, Israeli withdrawal, and reconstruction—key steps to achieving lasting peace.

In other news we have some Congress trades to cover this week:

Kevin Hern (R) (with an estimated net worth of $107M) had numerous sales in (BSC), (STX), (HD), (MSFT) and more +. He sold up to $420k worth of stock and purchased up to $30k worth of stock.

Back in 2021 Marjorie Taylor Green (R) bought Truth Social stock (TRUTH), the stock purchase is now down nearly -90% since inception.

Rep Cleo Fields (D) filed 11 trades on 11/12/25, mostly purchases. These included:

2x Nvidia stock purchases up to $300k. (NVDA) is down nearly +8% vs an S&P 500 flat -0.96% since trade.

He sold his Chipotle position of up to $50k. (CMG) is down nearly -5% vs an S&P 500 flat -0.96% since trade.

2x Apple stock purchases of up to $750k. (AAPL) is up +4.03% vs an S&P 500 flat -0.96% since trade.

In April, Senator Ted Cruz (R) sold up to $500k in Goldman Sachs stock, causing him to miss out on a +97% return since his sale. This was a partial (GS) sale he still maintains some position in the stock.

Fundraising:

We've received Q3 fundraising data for members of Congress. Here's who's fundraised the most & the % of individual donors contributions:

🔵Raja Krishnamoorthi: $12.2M (96%)

🔵Jon Ossoff: $12.08M (99%)

🔵Roy Cooper $10.92M (91%)

🔵Sherrod Brown $7.02% (90%)

🔵James Talarico $6.27M (100%)

DATA ROUNDUP

Introducing New Tabs on Politicians Dashboard

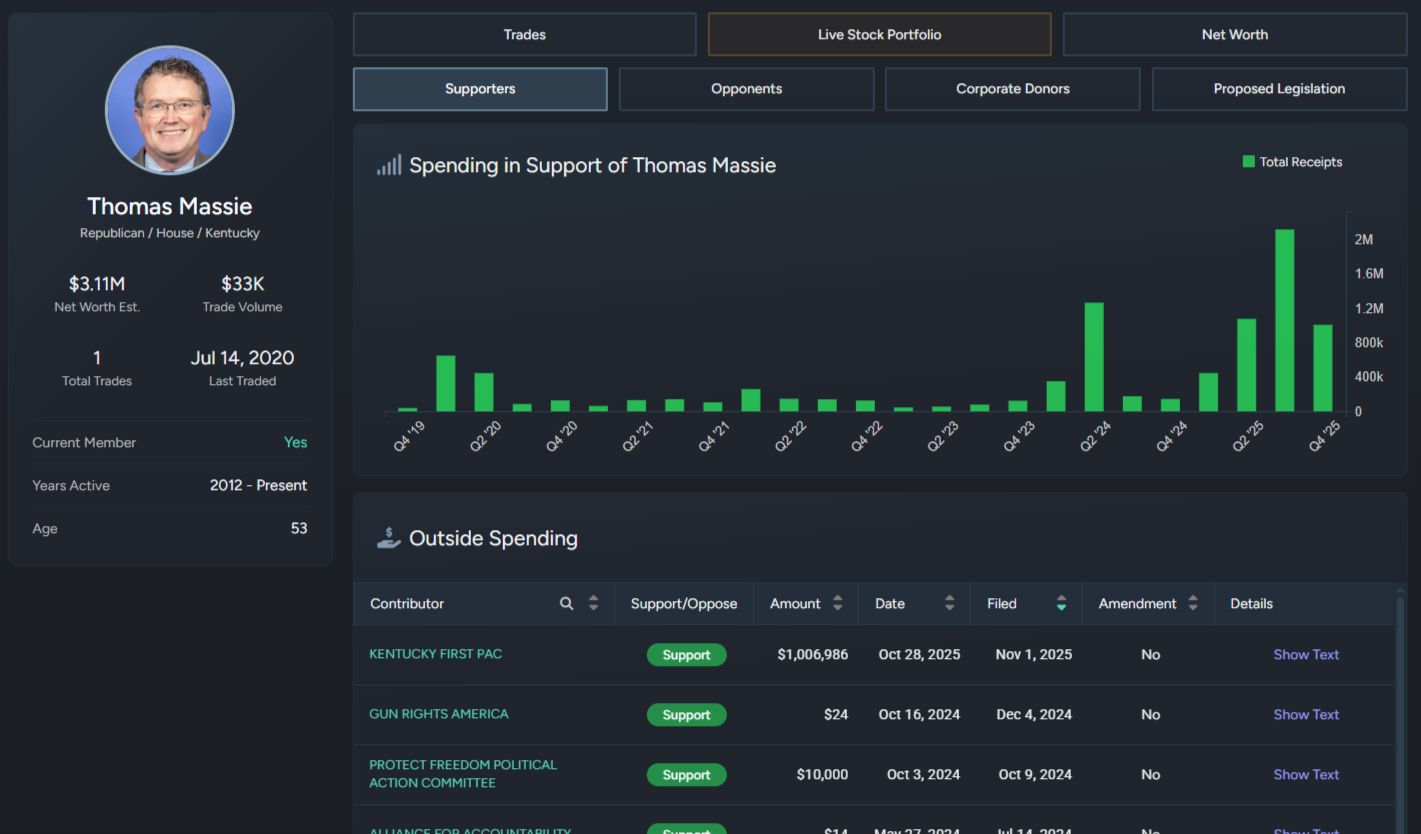

Quiver’s Politicians Dashboard just got more powerful. Our newest update introduces two data-rich views—Supporters and Opponents—giving you a comprehensive look at the financial forces shaping any politician’s campaign.

Whether you’re analyzing how fundraising momentum is building or who’s spending against a candidate, these new tabs provide the transparency you need to follow the money behind political influence.

Supporters Tab

The Supporters tab makes it easy to track campaign funding at both the granular and historical level. Dive into total receipts by quarter, view outside spending, and identify the top contributors backing each candidate’s committee.

With just a few clicks, you can see which organizations and donors are driving a politician’s financial strength. Every row in the Outside Spending and Top Receipts tables links directly to our committee pages, where you can analyze detailed data on Fundraising, Disbursements, Expenditures, and Cash on Hand.

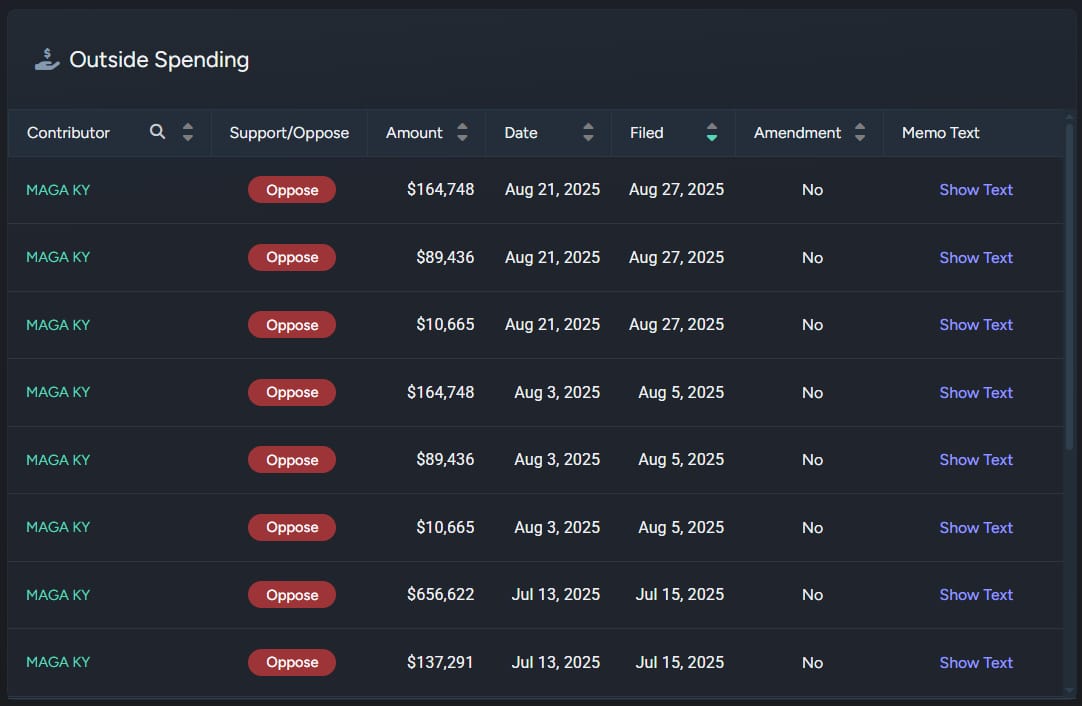

Opponents Tab

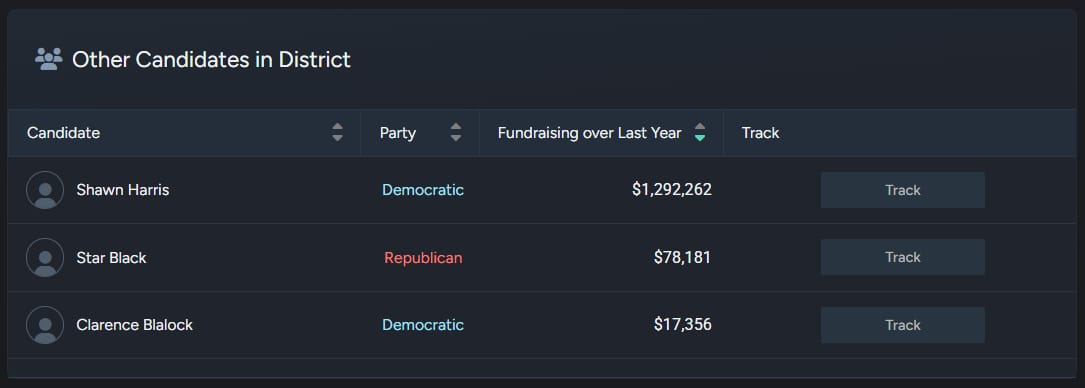

The Opponents tab flips the perspective, showing campaign spending and financial activity aimed at a candidate’s defeat. Follow the flow of outside money opposing a campaign, and compare it against the fundraising strength of rival candidates within the same district.

The “Other Candidates in District” table lets you toggle seamlessly between each politician’s page, making it easy to see who’s gaining traction in competitive races.

Representative Thomas Massie, for instance, stands out as a timely example with a surge in recent fundraising activity visible across both views.

Insights from our Quiver Politician Dashboard

NEWS

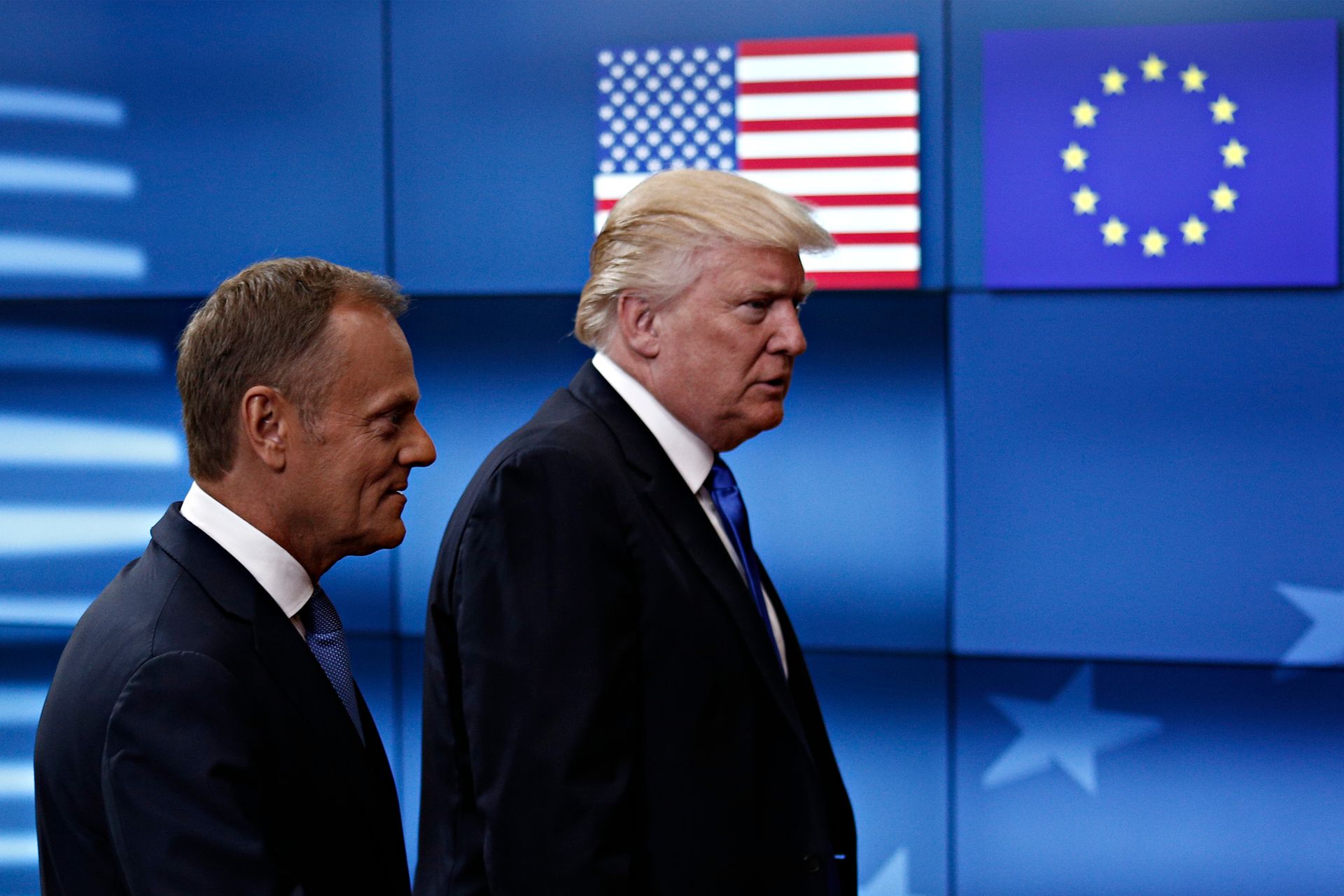

Trump’s Portfolio Shift Signals Policy-Driven Investment Strategy

President Donald Trump disclosed new investments totaling at least $82 million in corporate and municipal bonds between late August and early October, expanding his holdings into sectors poised to benefit from his administration’s economic agenda. The filings, released by the U.S. Office of Government Ethics, show more than 175 separate transactions under the 1978 Ethics in Government Act, though each provides only broad value ranges. Most purchases involved state and local debt, but Trump’s latest portfolio moves also included corporate issuers across technology, banking, and retail—industries that have thrived under deregulation and infrastructure spending.

The disclosures highlight Trump’s renewed focus on fixed-income assets as interest rates stabilize and market volatility grows. Corporate bonds purchased include offerings from Broadcom (AVGO), Qualcomm (QCOM), Meta (META), Home Depot (HD), CVS (CVS), Goldman Sachs (GS), Morgan Stanley (MS), and JPMorgan (JPM). He also acquired Intel bonds shortly after the government, under his direction, took a strategic stake in the chipmaker—an overlap that could draw fresh scrutiny. Analysts noted that these positions align with his administration’s policy priorities, from reshoring semiconductor production to bolstering domestic manufacturing and technology independence.

Market Overview:

Trump purchased at least $82 million in corporate and municipal bonds from late August to early October

New investments span technology, retail, banking, and healthcare sectors

Disclosure filings cite 175 transactions without detailed valuations

Key Points:

Corporate bond holdings include Broadcom, Qualcomm, Meta, Intel, and major U.S. banks

Intel acquisition followed U.S. government’s stake purchase under Trump’s direction

Municipal bond exposure remains largest share of portfolio by volume