- Quiver Quantitative

- Posts

- Congress bought millions in Nvidia 📈

Congress bought millions in Nvidia 📈

An update on the latest congressional trades, our new insider tabs, and why Apollo eyes trillions in sports investments.

QUIVER PREMIUM

Check out our top Performing Strategies

Each week, we are highlighting the top Quiver Strategies trending right now:

In today’s edition:

POLITICS

Congress Trades & News

Insights from our Congress Trading Dashboard

Several politicians & members of Congress have already made millions of dollars in the stock market in 2025:

Congress continued to create market movement last week, with several developments poised to impact portfolios:

Key Events:

Crypto Legislation: Capitol Hill is spotlighting digital assets, with new bills debated to tighten oversight and block the rollout of a U.S. central bank digital currency. This could reshape regulatory risk for everything crypto-adjacent.

Education Shake-Up: The Supreme Court greenlit major layoffs at the Department of Education, hinting at changes for federal education vendors and contractors.

Foreign Policy Moves: The Trump administration pledged advanced weapons to Ukraine while hinting at new Russia tariffs and sanctions—energy and defense sectors are watching closely.

State Battles: California House Democrats are discussing the possibility of gerrymandering the state in response to a potential Texas gerrymander.

Here’s how members of Congress have been managing their own portfolios amidst this ongoing activity:

Rep. Michael McCaul (R) & Rep. Cleo Fields (D) both have been trading Nvidia (NVDA) during June and July:

Fields bought up to $6.8M in June.

McCaul sold up to $1.25M in June.

Rep. Brandon Gill (R) just filed up to $1.5M in Bitcoin purchases. Gill sits on the House Committee on the Budget. He also bought (QQQ), (DIA), and some government securities.

Rep. Marjorie Taylor Greene (R) bought up to $30K worth of Palantir stock back in April 2025. We reported on this as soon as the disclosure was filed, because Greene sits on the House Committee on Homeland Security. (PLTR) has now risen 92% since her purchase.

Fundraising:

We've received Q2 fundraising data for members of Congress. Here's who's raised the most:

🔵 Rep. Jon Ossoff (D) $10.09M

🔵 Senator Cory Booker (D) $9.69M

🔵 Rep. Alex Ocasio-Cortez (D) $5.82M

DATA ROUNDUP

Featured Quiver Datasets

NEW: Enhanced Insider Tab on Stock Ticker Pages

Staying informed about insider trading can offer a unique lens into corporate sentiment. With that in mind, we’ve been developing new tools to make it easier to track insider trading data.

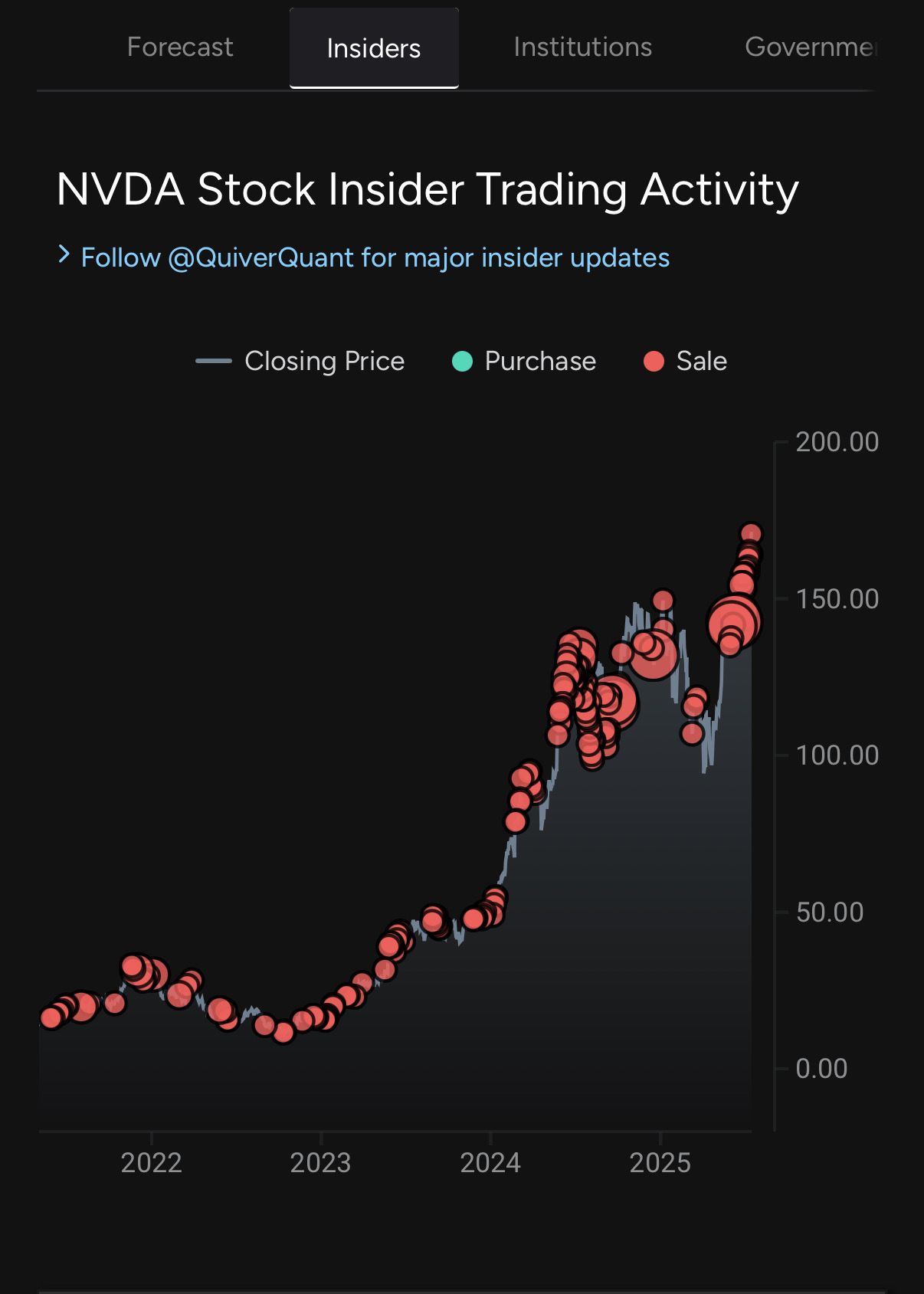

We recently launched a new “Insiders” tab on our ticker pages (example: NVDA Insider page) to visualize all of the insider activity at a specific company.

Here’s how our updated Insider Tab on Quiver Quant empowers your investment research:

Visualizing Insider Moves at a Glance

Spot the most significant insider trades—larger bubbles correspond to higher transaction volumes. The example above shows several notable sales by Nvidia’s CEO, Jensen Huang.

Visualizing Insider Moves

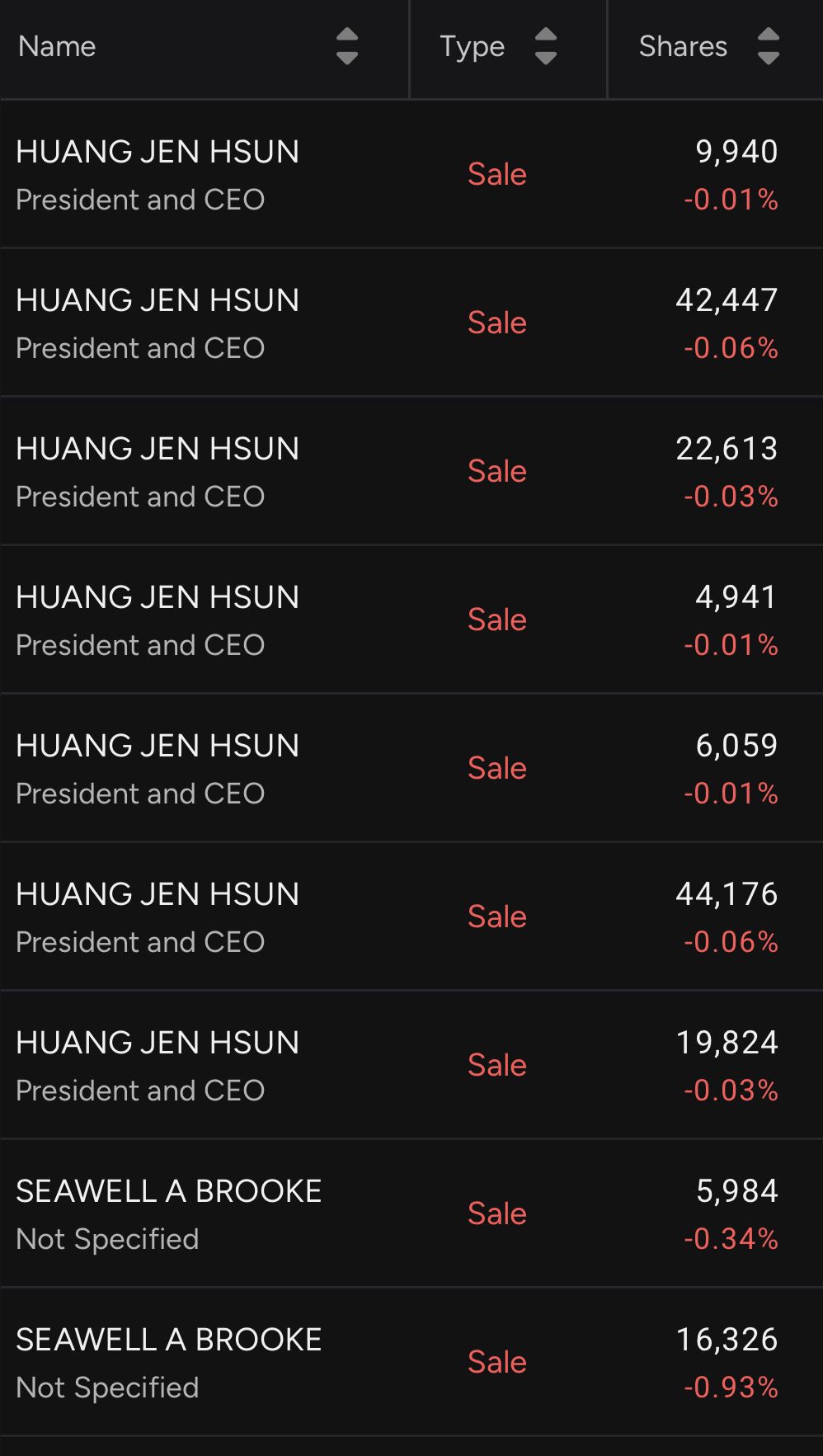

Sift through trades by executive name, sale or purchase type, or number of shares moved.

This reduces noise, helping you focus on high-impact transactions without wading through routine filings.

Contextualize with Trend Data

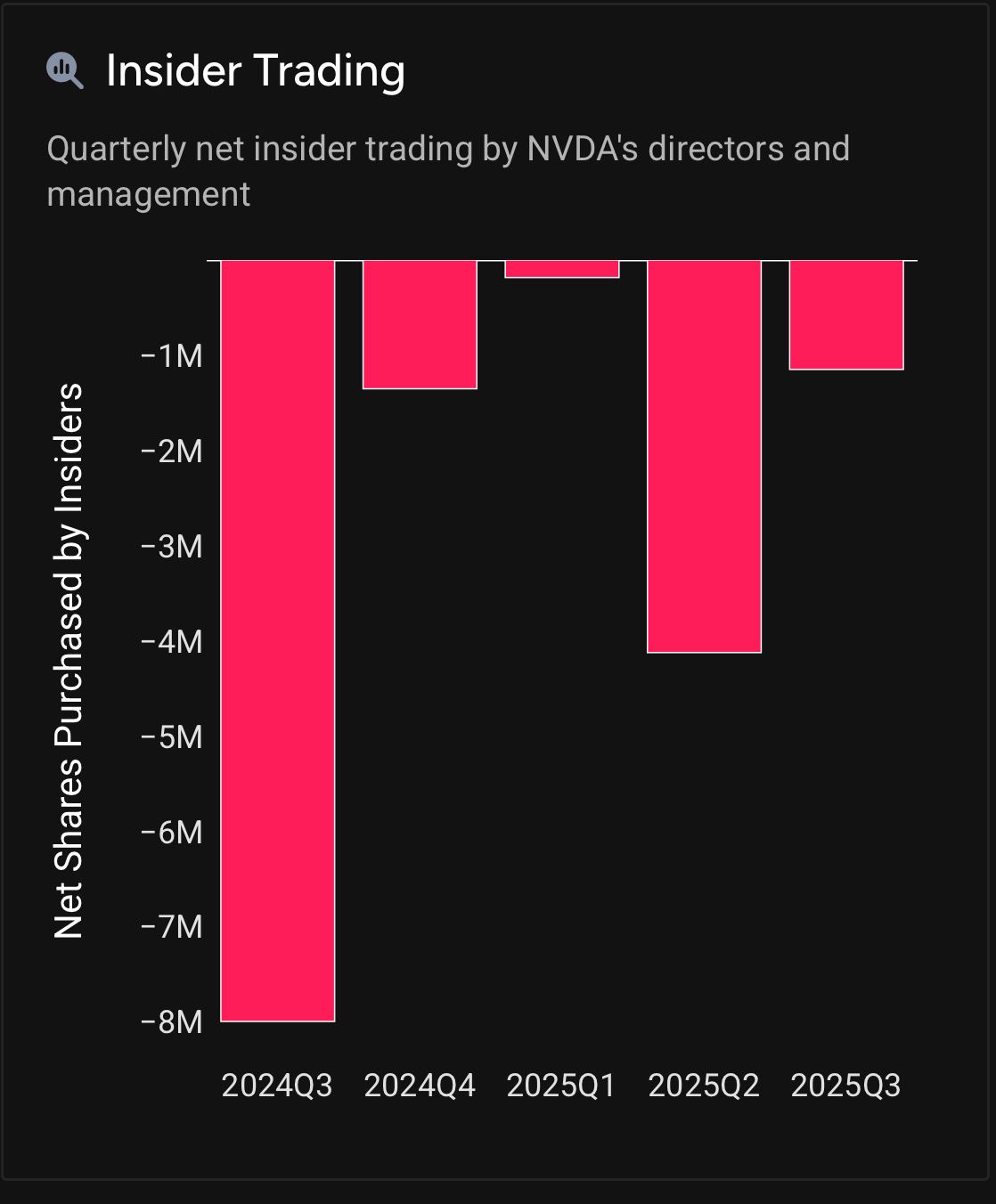

Our net insider trading chart by quarter reveals whether buying or selling is accelerating or cooling off.

Spotting a streak of net sales, for instance, can flag periods of shifting executive sentiment before it’s widely discussed:

How to Get More Out of Insider Data

Focus on repeat or outsized transactions, especially from the same executive.

Compare insider sentiment to institutional and government trading trends (all in one place). Use quarterly net numbers as a reference for shifts in management conviction.

Insights from our Quiver Dashboards

NEWS

Why Alt Managers Apollo (APO) & Others See Trillions in Sports Adjacencies

Apollo Global Management (APO) and Ares Management (ARES) are escalating their push into sports, sketching out dedicated vehicles to finance leagues, teams and the broader media ecosystem. Ares is courting individual investors with a semi-liquid media and entertainment fund that can deploy both debt and equity—a notable shift from the clubby world of sports finance. Apollo, meanwhile, is weighing a permanent capital vehicle aimed at longer-dated lending to franchises and leagues, with the flexibility to take equity when it makes strategic sense.

These moves ride a powerful tailwind: last year’s NFL rule change opening team ownership to private equity, alongside a surge of deal flow from clubs seeking liquidity without ceding control. Apollo has already inked loans to European football sides like Sporting Lisbon and Nottingham Forest, while Ares’ first dedicated sports fund closed in 2022 at $3.7 billion and has since bought into the Miami Dolphins and other franchises.

Market Overview:

Alternative asset managers see sports as a durable, underpenetrated cash-flow stream

NFL’s private equity green light catalyzes new fund structures targeting minority stakes

Retail distribution channels are emerging as managers chase fresh fee pools

Key Points:

Ares is launching a semi-liquid fund for individuals to invest across sports media and teams

Apollo is considering a permanent capital vehicle focused on lending to leagues and franchises

Ares targets $100B from individual investors by 2028; potential $600M in fees from this initiative